The Challenges

Bombay Stock Exchange had been physically monitoring print media to identify suspected news rumours from material information that may have an impact on the price / volume of securities listed on its platform.

Due to capital market compliances, companies listed need to inform the Exchange about all events, which will have bearing on the performance of the company as well as price-sensitive information. Any material news or rumour floating on social media/news websites can have a very big potential of impacting the sentiments of the investing population which can further impact price / volumes of securities traded on exchange platforms.

The Stock Exchange keeps an eye on the news, opinions and recommendations to understand the context of this information. This is a critical activity as typically; market intermediaries and investors tend to trade based on the information that is about to impact the stock / asset. The process of such physical scanning led to the following challenges –

To overcome these challenges, the client required solutions for establishing a consolidated Modern Data Platform.

- Manual monitoring of print media to identify suspected rumors

- Non tracking of social media information influencing stock prices (Twitter, Facebook, Blogs, Web Articles etc.)

- Chances of missing out relevant information affecting stock prices

- Limitations in processing high volumes of unstructured Data

- High human resource dependency

- Limitations to carry out complex analytics quickly

Solutions

Datametica assisted BSE to build a systematic solution that relies on machine learning techniques to track news related to listed companies on news websites and social media like Twitter, Facebook, etc. The end-to-end solution was developed on a distributed system – Hadoop to support the economies of scale.

- The entire process of reading and tagging content was automated using machine learning algorithms.

- Unstructured data sources (social media) were converted into tokens/words for processing further noise were filtered using Natural Language Toolkit.

- Support vector machines consider this dimensional space of tokens /words for generating scores based on weights obtained in a data-driven manner

- Worked with keywords to look for in the tagged articles.

- We refined the untagged set by understanding the surveillance team’s business process and trained the statistical Algorithm.

Datametica Acceleratored Approach

- Developed a base framework for ingesting content from social media sites (Twitter / Facebook) and news websites.

- Built a Model using Machine Learning algorithms to process and identify suspicious content

- Built dashboards and alerts

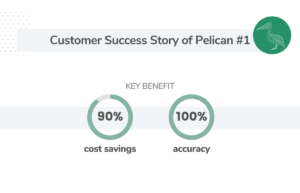

Client Benefits

Datametica’s solution led to improved operational efficiency of the surveillance team at BSE while setting the right base that can be steadfast through future rumor challenges.

Salient benefits of our solution

- Broader Coverage of Social Media

- Increased Investor Confidence

- Improves Productivity Transparency

- Reduced Time for Processing

- Minimum Human Intervention

Client Testimonial

”Social media analytics solution implemented by Datametica provided us a framework to mitigate the potential risks of stock manipulation and information asymmetry”- Ashish Chauhan,CEO,Bombay Stock Exchange.

Ashish ChauhanCEO, Bombay Stock Exchange

Recommended for you

subscribe to our case study

let your data move seamlessly to cloud